2024 marks a pivotal time in the global shift toward flexible working and workspaces. During the year, the office market continued its strategic recalibration, with small and large companies shifting to locations that enable greater flexibility and operational efficiency.

The office rental market grew steadily in 2024. In the first half of the year, our research found that premium offices in Europe grew by 5.5% driven by a significant number of businesses renting Class A, ESG-focused offices. Between 2021 and 2024, office rental prices rose in Central London (the West End in particular) by an average of 10.5%.

Our office market analysis reveals that 2024 was a good year for the serviced office industry. The number of businesses and individuals renting flexspace and coworking spaces increased in 2024, reaching multi-year highs in both London and other UK cities.

Let’s take a closer look at the statistics in London and the UK in general.

London Market Analysis 2024

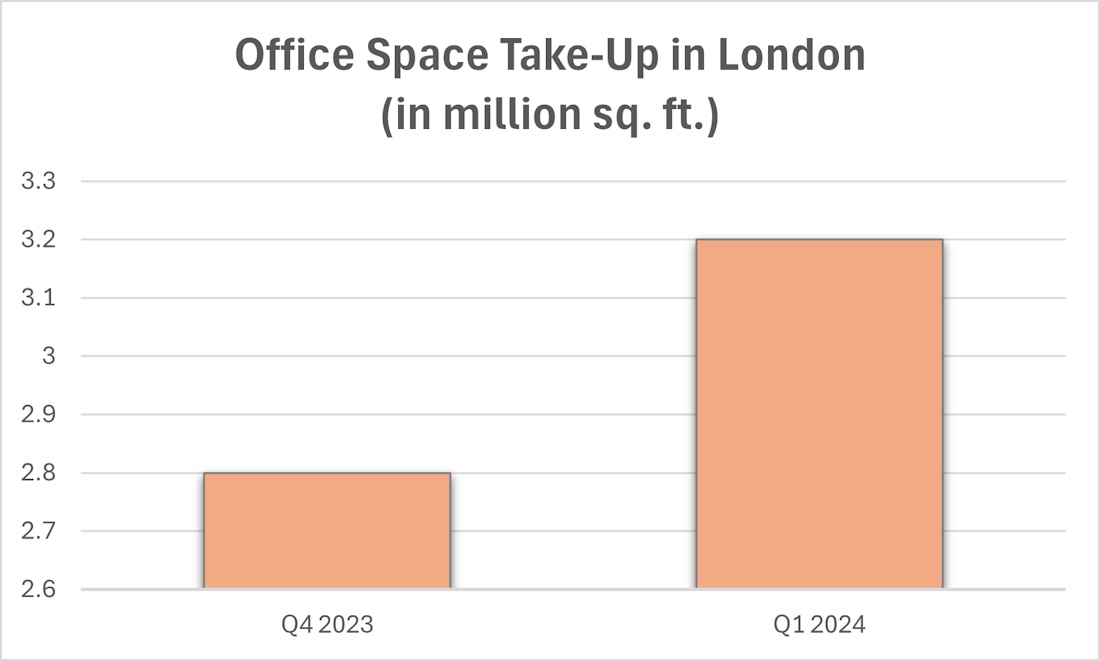

New office take-up in Central London in Q1 of 2024 totalled 3.2 million sq. ft., up 16% from Q4 2023. By the end of the year, over 50,000 sq. ft. of office space transactions had been completed.

Overall, the number of office transactions was 3% higher than the previous year, with all office sizes experiencing an increase. Demand surged for new or refurbished offices, which accounted for 68% of all transactions. Similarly, BREEAM-rated ‘Excellent’ and ‘Outstanding’ buildings comprised 59% of office acquisitions.

73.6% of London’s office take-up in 2024 can be attributed to Grade A office space. Clearly, the demand for top-quality, amenity-rich workspace remains high, which is why rents for prime workspaces reached record levels. Financial sector occupiers typically dominate the London office market, and 2024 was no exception. The Insurance and Financial sectors were responsible for 34% of office renting activity this year.

UK (Regional) Market Analysis 2024

Office take-up in the UK’s six major cities outside London (Birmingham, Bristol, Edinburgh, Glasgow, Leeds and Manchester) was also positive in 2024.

Take-up totalled 1.3 million sq. ft. in Q3 of 2024 (the highest level recorded since Q4 of 2022). By the last quarter, it had reached 3.3 million sq. ft, which was 24% higher than the same period of 2023.

Birmingham saw the most significant surge in demand for workspace, with deals increasing by 100%.

Manchester claimed the largest deal of the year with 200,000 sq. ft. at 4 Angel Square in the NOMA campus, signed by the Bank of New York Mellon - the largest office deal in Manchester in four years.

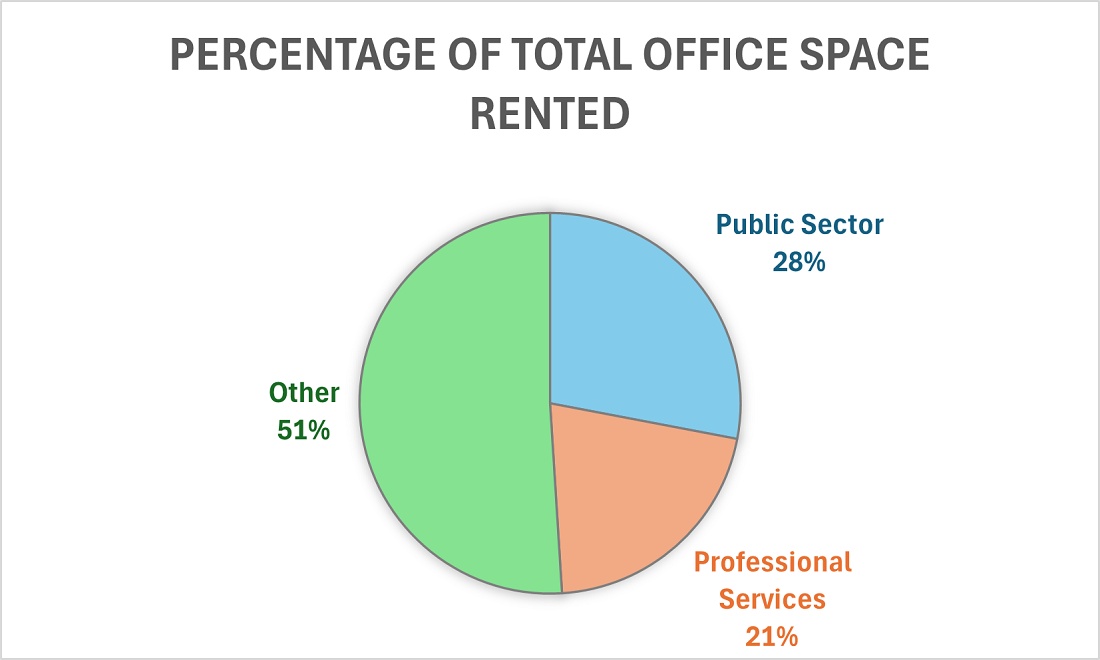

While the financial sector continues to drive office take-up in London, the public sector (28%) and professional services (21%) are driving office take-up in the six big regional cities. Like London, there has also been a growing demand across the UK for high-quality, Grade A workspace.

Falling vacancy rates in new office buildings are indicative of this trend, with Edinburgh reporting a 0.1% vacancy rate and Glasgow reporting a 0.4% vacancy rate.

Rental prices also rose across the UK in 2024, especially in prime office spaces. By the end of the year, they were on track to have risen by 6.2% on average, a rise from 4.5% in 2023 and the highest in 18 years.

However, data reveals a lack of prime offices in development in 2024, with just 1.5 million sq. ft. under construction at year-end (a third of which is in Manchester). It is the lowest level in regional cities since 2012. This low supply could be further exacerbated by the tightening of energy performance standards: the minimum standard will rise to EPC-grade C by 2027 (it is currently EPC-grade E).

Office Trends to Look Out for in 2025

Moving into 2025, the serviced office market is set to evolve and shift.

The demand for Grade A offices and workspaces in prime locations will continue to rise, as will the appetite for ESG-centred office spaces.

Meanwhile, we can expect to see falling occupancy in legacy buildings and offices that are unable to adapt to meet the evolving needs of occupiers. The market already favours agile, future-ready offices that keep technology and sustainability at the heart of their strategy, and this isn’t set to change.

1. Hybrid-first workspace design

Hybrid working is impacting office design, and it’s set to become even more influential next year. This workspace trend is all about flexible layouts that can accommodate a fluctuating workforce that is part office-based and part home-based.

Modular setups are key: movable furniture, collaboration hubs, tech-integrated spaces and quiet pods. These spaces can facilitate fluid interactions among the workforce while still allowing for quiet and focused work.

Work isn’t a place anymore; it’s an activity. Therefore, companies are seeking to foster stronger team cohesion, and office design is a key factor that can either enhance or undermine workplace synergy.

2. Flexible membership plans

Serviced offices have been transforming the way organisations rent workspace since the 1990s. More than ever, businesses are switching their office leases for flexible, short-term, serviced office and coworking agreements. A huge incentive is that Flex spaces offer access to a national or global network of spaces that can accommodate a decentralised workforce.

The coworking model enables businesses to test new markets without a significant upfront investment. Employees can work in community-focused environments alongside other professionals, without the need to rent a private office full-time.

3. AI-optimised serviced offices

AI is expected to continue having an impact on serviced office management in 2025. Intelligent lighting, heating and cooling are fast becoming the norm, enabling offices to save on overheads and limit their carbon footprint. Algorithms are helping operators to maximise usage by identifying patterns in occupancy.

More broadly, AI is helping office managers to make data-informed decisions about layout, agreement terms and growth. Serviced office and coworking management systems can track occupier satisfaction and make suggestions for improvement. As such, the standards are set to become even higher. To compete, offices must excel in all areas - from customer service and events to amenities and office design.

4. Wellness-centric environments

In 2025, wellness-centric features and facilities will be a key incentive for businesses seeking a physical space as they help to support a meaningful company culture. Ergonomic furniture, natural lighting, air purification systems, and biophilic design are no longer desirable features: they are must-haves.

Some flexible workspaces will differentiate themselves by offering on-site therapy or access to discounted digital therapy platforms. By investing in wellness aspects, office providers - and in turn, the businesses that rent space - are signalling care for employees, while driving down absenteeism and presenteeism.

5. Decentralised and hyperlocal hubs

One of the most significant factors affecting the office rental market as we move into 2025 is decentralisation. Instead of a single headquarters, employees will work from satellite hubs located in smaller cities, towns, and suburbs.

The decentralisation model is proving increasingly popular, as it reduces commute times and supports a work-life balance. Crucially, it enables organisations to recruit diverse talent outside of major cities. These spaces, in addition to contributing to the local economy, also foster cross-company networking and creativity.